Cautious Land Market Holding Its Own

__primary.png?v=1719520405)

Article from Summer 2024 Hertz Outlook Newsletter

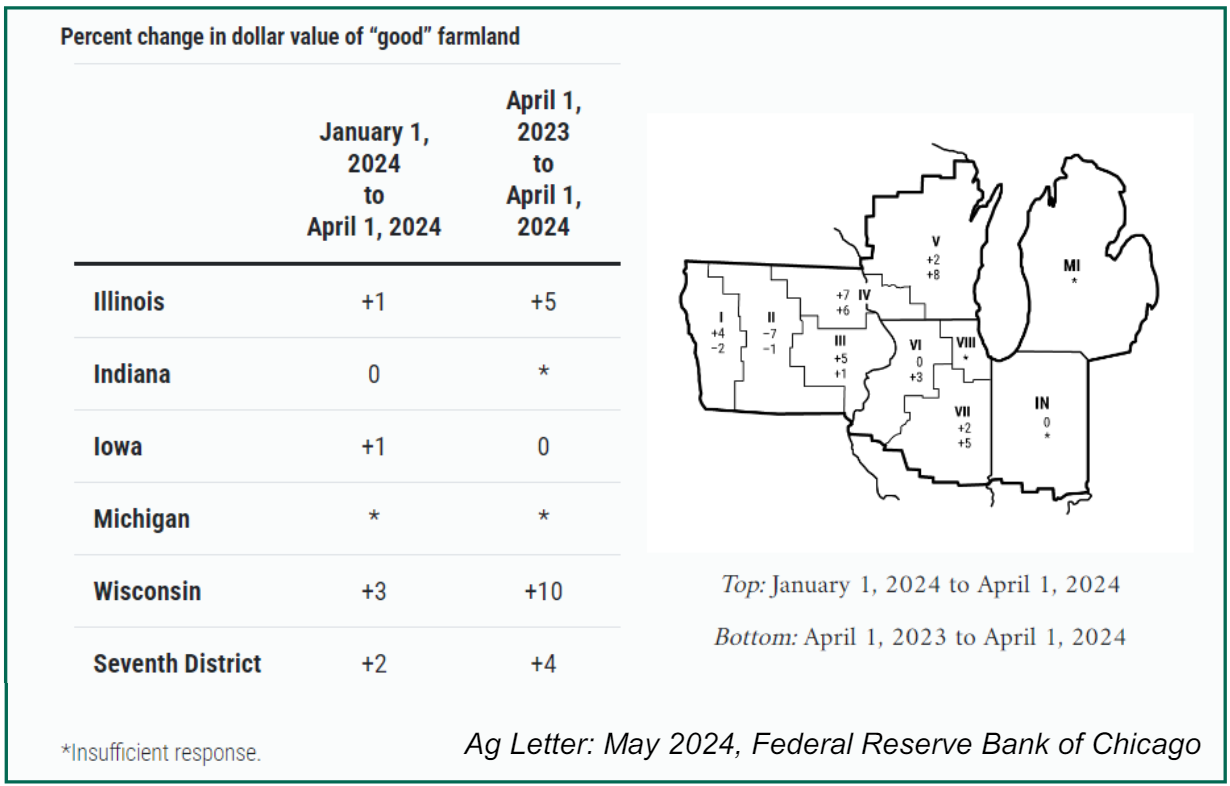

Since the beginning of the year, the farmland market has not changed all that much, reports Doug Hensley, president of Hertz Real Estate Services. “We are still facing low commodity prices, high interest rates and high input costs, none of which is overly sustainable for strong and appreciating farmland values,” says Hensley. Yet, despite the strong headwinds in the farm economy, the farmland market is holding its own and, so far, has been chopping sideways.

“Marketwide, we’ve seen a low volume of sales and the bias of economic factors is toward weakness in the land market,” says Hensley. However, it’s noticeably different from one neighborhood to the next. “One strong farm sale does not mean a strong land market overall. And one weak sale doesn’t mean another farm won’t bring a better-than-expected offer,” Hensley reports.

And farmers have become more cautious. Given the economy, farmers are reluctant to make capital purchases, especially equipment, as headlines report layoffs by equipment manufacturers. But the farmland market is more resilient than farm equipment. Hensley explains, it’s easier to say “no” to buying a tractor or combine upgrade when not making a profit versus buying a piece of land. You can’t control when a neighboring farm is offered on the market. Whereas a similar tractor, harvester or implement will be available when strong profits do return, you can’t say the same about an adjacent farm. “It’s harder to pull the trigger when you’re not making money, but some land buyers will begrudgingly buy farmland because it may not become available again in their lifetime,” Hensley advises.

There is still considerable liquidity in the countryside from profits made in 2021 through 2023, but farmers are increasingly protecting their finances. So far, demand remains adequate to absorb the current supply of farmland for sale, thereby largely maintaining price stability. “This year we’ll have to grow a heck of a crop to make a profit,” Hensley remarks. “And, unfortunately, we didn’t start out perfect this spring. This is the most uneven planting season we’ve had in a few years, and it certainly hasn’t added confidence across the market leading into the growing season. So, what happens in June, July and August will be key to the farmers’ profits (and attitudes) this year,” Hensley concludes.

“The short-term trajectory for farmland values remains cautious.”