Bankers Report Moderate Land Value Growth and Tighter Credit Conditions

__primary.png?v=1719520925)

Article from Summer 2024 Hertz Outlook Newsletter

Despite soaring interest rates, farmland values held steady or slightly increased in the first quarter of 2024 according to banker surveys in the Federal Reserve Bank districts of Chicago and Kansas City.

Illinois farmland saw a 1% increase in the first quarter of this year and was up 5% from April 1, 2023. Iowa bankers also reported a slight 1% quarterly increase, but values were flat compared to a year ago. Indiana farmland values stayed steady, while Wisconsin showed the most growth, up 3% for the quarter and 10% for the year. A district-wide average annual increase of 4% in farmland values was the smallest year-over-year growth since the third quarter of 2020.

Further west in the Corn Belt, the Kansas City Federal Reserve Bank district reported that nonirrigated and irrigated cropland was up 6% compared to a year ago.

These backward-looking surveys strike a contrast to Creighton University’s most recent Rural Mainstreet Index survey of bankers, which for the first time in more than four years, detected weakening farmland price growth. Only 4.2% of the bankers surveyed in the ten states including Illinois, Iowa and Nebraska, reported farmland values expanded from previous levels.

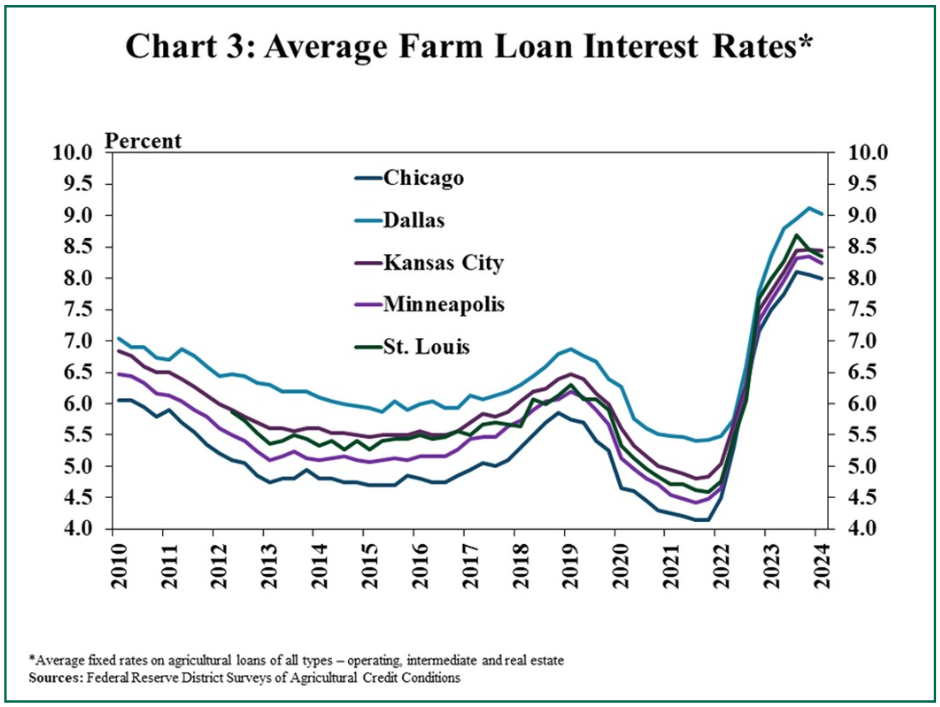

Farm buyers are feeling the pinch from tumbling commodity prices and skyrocketing interest rates (see table). Average farm loan interest rates this past year hit the highest levels since 2007.

“Farmers’ demand for agricultural loans increased and repayment rates declined in the first quarter of 2024, as farm income deteriorated further. However, despite some tightening in financial conditions, farm household spending remained robust and balance sheets appear positioned to sustain thinner profit margins in 2024,” reported the agricultural economists at the Kansas City Federal Reserve, which covers Kansas, Nebraska, Oklahoma, western Missouri, Colorado, Wyoming and northern New Mexico.

Annual cash rental rates in the Chicago Federal Reserve Bank district also slowed their increase. While cash rents rose for a fourth year in a row, the increase was only 2% -- much slower growth compared to the previous three years. For 2024, at the State level, average annual cash rents for farmland were unchanged in Illinois and were up 4 percent in Indiana, 1 percent in Iowa, and 6 percent in Wisconsin.

Bankers in the Creighton University survey reported average cash rents of $245 per acre for non-irrigated cropland. The ten states in the Creighton survey include Colorado, Illinois, Iowa, Kansas, Minnesota, Missouri, Nebraska, North and South Dakota and Wyoming.

In the May 2024 Chicago Federal Reserve Ag Letter, an Iowa banker reported, “projections for 2024 show most farmers breaking even or going backwards in equity and working capital.” This view seemed widespread in the district, observed agricultural economist David Oppedahl, author of the Chicago Fed Ag Letter.