Grain Markets - Summer 2023

__primary.png?v=1686242000)

The corn and soybean markets continue to experience significant volatility. Agriculture has been fortunate to experience strong commodity prices for the past several years, and U.S. corn and soybean yields have been relatively consistent during that period. Fortunately, demand for those commodities has also been strong. In 2020, the U.S. enjoyed record quantities of corn and soybean exports. In 2021, the U.S. enjoyed record export values due to strong commodity prices.

The continued strong commodity prices have incentivized increases in global production. Even though crop input prices increased significantly since 2020, the elevated commodity prices have been more than enough to cover these increased costs and provide strong profit levels. At the same time, exports have fallen, and this has been a challenge for the 2022 and 2023 marketing years.

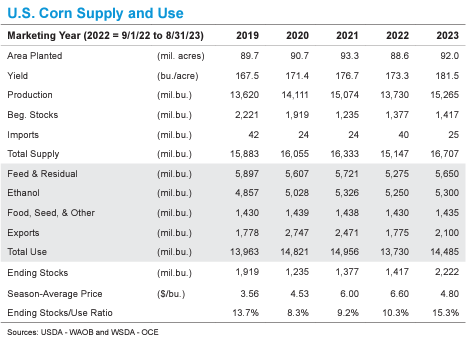

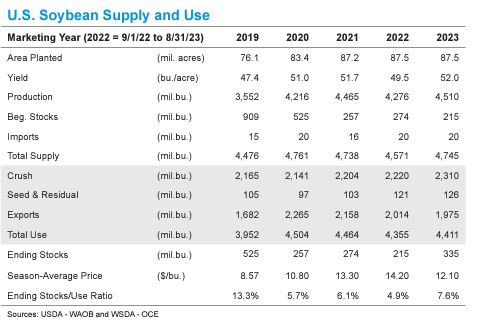

The historical supply and use of U.S. corn and soybeans is shown in the following tables.

For corn, the USDA projects an increase in acres for 2023. This increase in acreage combined with an anticipated record yield of 181.5 bushels per acre will result in the second highest corn production level on record. The USDA yields are based on weather-adjusted trends. Use of corn will increase in 2023, but likely not enough to offset the increase in production. The corn ending stocks to use ratio will increase from 10.3% in 2022 to 15.3% in 2023. If realized, this stocks to use ratio would be the highest since 2018. Higher ending stocks typically reduces the trade’s reaction to weather related production concerns during the growing season. The anticipated season average price for corn is projected to be $4.80 per bushel.

For soybeans, the USDA projects 2023 planted acres will be the same as 2022. The projected yield is 52 bushels per acre, an increase of approximately 5%. Soybean use is estimated to increase as well with projected ending stocks to use ratio increasing from 4.9% in 2022 to 7.6% in 2023. The anticipated season average price for soybeans is projected to be $12.10 per bushel.

The 2023 corn and soybean crops were planted at a pace ahead of the 5-year average, and rapid planting is typically key in realizing trendline yields. In the beginning of 2023, there was a transition from a La Nina weather pattern to a neutral weather pattern. The NOAA Climate Prediction Center is forecasting a further shift to an El Nino weather pattern this summer. During El Nino patterns, the Midwest U.S. typically experiences slightly warmer weather with above average precipitation which is also favorable for U.S. crop yields.

On a global scale, the Russia – Ukraine war continues to have an impact on the supply of corn and wheat. The volume of production and exports from this region have been reduced significantly since this war began, and this reduction has supported commodity prices. How long will this war continue? Drought in Argentina has reduced their corn and soybean yields, but excellent weather conditions in Brazil have led to near record crop production which will likely offset the yield reductions in Argentina.

After extended bull markets in both corn and soybeans, we are in a period of increasing ending stocks which will pressure season average prices. Weather concerns during the growing season typically initiate market rallies, and producers should take advantage of these selling opportunities during these rallies. We will likely not see commodity prices as high as the past several years due to increasing carryover stocks. Fortunately, producers can still make considerable profits when selling on these rallies.