Grain Markets - Summer 2024

__primary.png?v=1716475985)

Shifting Acres, Market Impacts, and the Road Ahead

At this time of year, in addition to the United States and World supply and demand numbers, the grain trade also focuses on the U.S. planted crop acres, early season weather, and growing conditions.

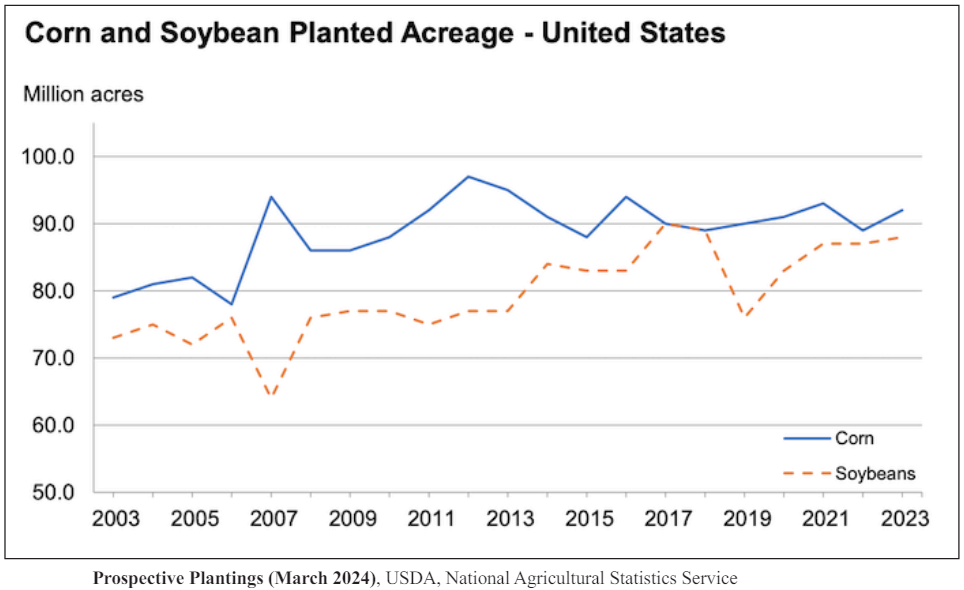

On March 28th, the USDA released the 2024 U.S. Planting Intentions Report. Based on commodity prices, anticipation was for reduced U.S. corn and increased soybean acres. The current estimate is that producers will plant 90.03 million acres of corn, which is 4.6 million or 5% less than the increased 2023 acres of 94.64 million. The 2023 corn acres increased from 88.2 million in 2022 and were the largest number of U.S. corn acres since 96.4 million in 2012.

For soybeans, the estimated acres are 86.51 million, which is an increase from 83.60 million in 2023. For comparison, the largest number of U.S. planted soybean acres were 90.2 in 2017.

The graph that follows shows the acres of corn and soybean acres planted annually since 2004. The March 28th estimate is based on producer surveys, and the updated acreage numbers will be included in the June 28th USDA Grain Stocks and Acreage Report.

Regardless of changes in the actual U.S. planted corn and soybean acres from the March estimate, if average yields are produced in 2024, there will be adequate supplies of U.S. corn and soybeans. Based on the forecasted planted acres, and a trendline average corn yield of 181 bushels per acre, the total production will again approach 15 billion bushels. For soybeans, a trendline yield of 52 bushels per acre would produce another crop of well over 4 billion bushels. With the current forecasted usage, the carryover supplies will continue to increase, likely leading to continuing price pressure.

Grain prices over the next several weeks will be influenced by the U.S. weather and yield prospects. Without U.S. summer weather problems, there again will be carry over corn supplies of over 2 billion bushels, and 300 million bushels of soybeans, which are more than adequate to meet current usage projections.

Other factors influencing corn and soybean prices near term include U.S. export demand, South American grain production and exports, and corn usage for ethanol.

Corn ethanol use was strong through the first half of the 2023-24 marketing year. Ethanol usage was up 6.4% from the same period last year. Ethanol use benefited from the increase of E15 fuel. The grain trade continues to monitor the issue of Biodiesel, renewable diesel, and biomass-based diesel, which long-term would be beneficial for U.S. grain usage.

With lower corn and soybean prices, we are in a cycle of tight margins. Early summer, when there is uncertainty over the crop production potential, is usually a good opportunity to establish prices for a portion of anticipated production. It is always critical to formulate a marketing plan and to take advantage of summer price volatility, until the grain trade is more certain of the 2024 production. For current management clients with participating leases, this is just a part of the valuable service we provide year in and year out.