Farmland Market Softens Heading Into 2025

__primary.png?v=1737471308)

"As we bring in 2025, we're seeing more of a bias toward softness than strength in the overall farmland market," observes Doug Hensley, President of Hertz Real Estate Services. “Although we still saw a few surprisingly strong auctions at the end of 2024, they have become fewer and further in-between.” Land prices are generally down 5% to 10% from a year ago, with some weaker neighborhoods down as much as 15%, Hensley reports.

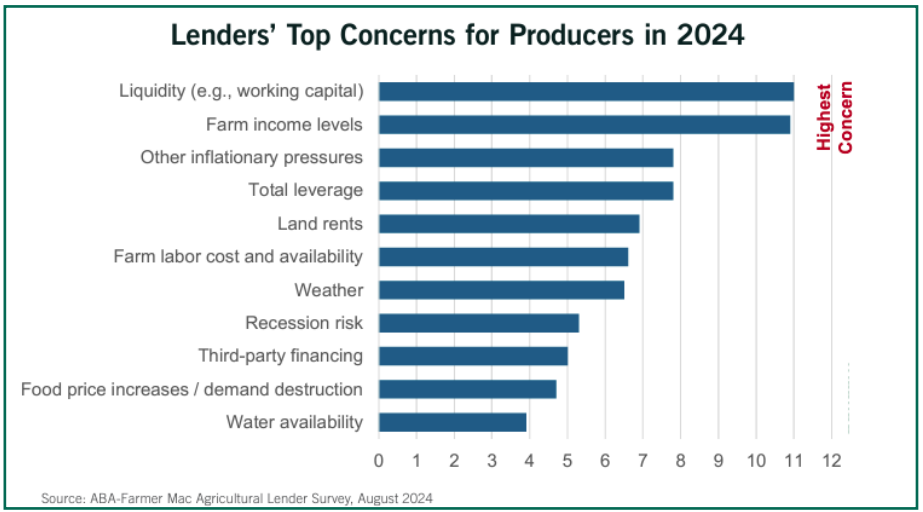

Farmland mortgage interest rates are hovering around 7.5% -- that’s a jump from the 4.5% to 5.5% long-term rates land buyers experienced from 2012- 2022, if they even needed to borrow money to buy land. The farm financial situation has deteriorated with lower commodity prices and higher interest rates. “Coming into 2024, farmers had strong working capital, but working capital has eroded this past year,” notes Hensley.

“In early 2024, we really started to see weakness in the grain commodity markets. As a result, profit margins today are thinner than they’ve been in the past five years,” Hensley explains. “This has created a narrower buyer base. Put simply, fewer hands are actively participating in land auctions.”

Fewer outside investors are looking at farmland, too. More attractive alternative investments have siphoned off many nonfarming investors from today’s market. And the slowdown in real estate development, primarily because of higher interest rates, has also meant a decrease in the number of 1031 tax-deferred, land exchange buyers.

There are still farmer buyers with a strong interest in neighboring property, but they are being more careful in today’s economic climate, advises Hensley. “Cautious lenders are also encouraging farmers to make prudent decisions,” notes Hensley.

Land sellers shifting expectations

A year ago, anyone thinking of selling a farm thought they could still get a near record sale price. Now, farm sellers are not expecting a record sale, Hensley explains. “Everyone wants last year’s prices, but buyers are not willing to bid that high, and sellers have largely adjusted to the different financial reality,” he adds.

As we look back over the past year, there was more softness in the market in August through October – basically the pre-harvest market – as predictions for low farm income turned farmers very hesitant until they better understood their harvest position and outcomes. And, Hensley reports, farmers harvested a bigger crop than they expected, which has helped to improve the negative attitude in the countryside. “I wouldn’t say attitudes have turned positive, but you can feel an improvement from late summer and early fall,” Hensley says. “That has helped to firm the land market to close the year, compared to early September.”

And, some landowners who considered a sale, but who are not in a hurry to sell, have just decided to hold onto their property. “Whenever we have market uncertainty, as we do today, it prompts some potential sellers to ‘tap the brakes’ and wait for improved market conditions,” Hensley explains.

In fact, public land sales volume is the lowest it’s been since 2020. And because there is not an excess volume of land for sale, that has also helped keep farmland prices from further weakening.

Cash leases remain mostly flat

“I don’t think we’ll see much change in cash rent leases from 2024 to 2025,” says Hensley. Farmland leases may be 0% to 5% lower, but better yields than most people expected will likely keep rents at status quo. “We out-busheled it in 2024. However, with tight profit margins and another year of working capital erosion in 2025, you’ll have red ink on income and cash flow statements. So, if we have another tough year, we will likely see more legitimate pressure on cash rent leases. I just think we are a year away from the possibility of those more significant adjustments,” explains Hensley.